Investing for Geniuses

Data Science and Mathematics in Investing

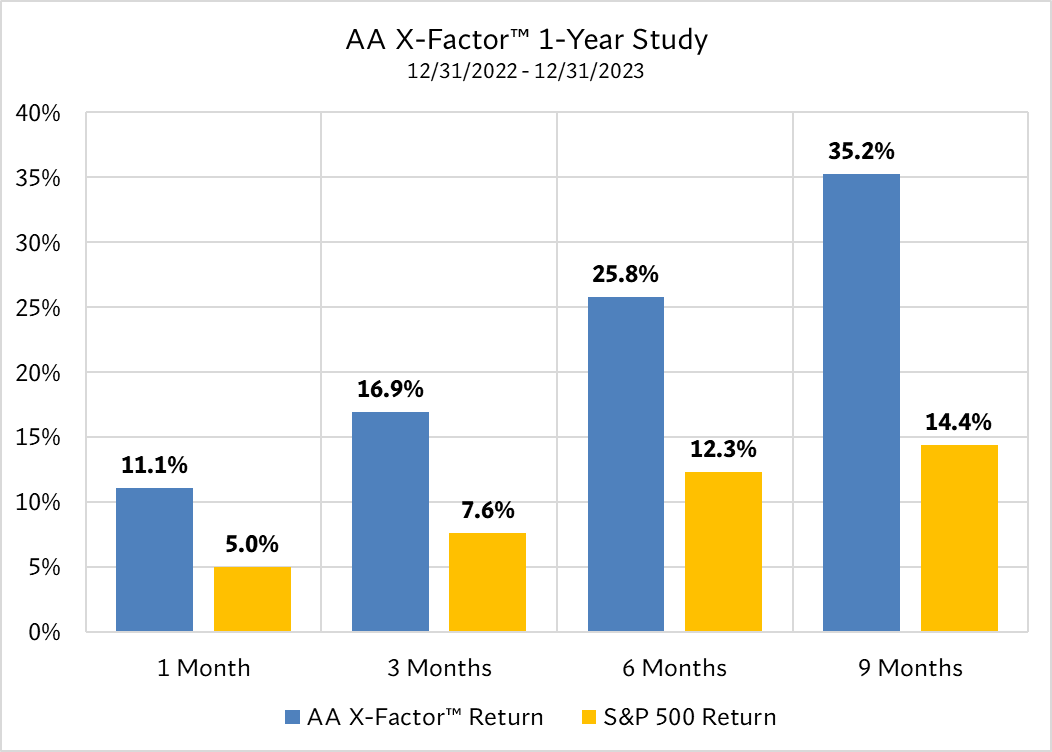

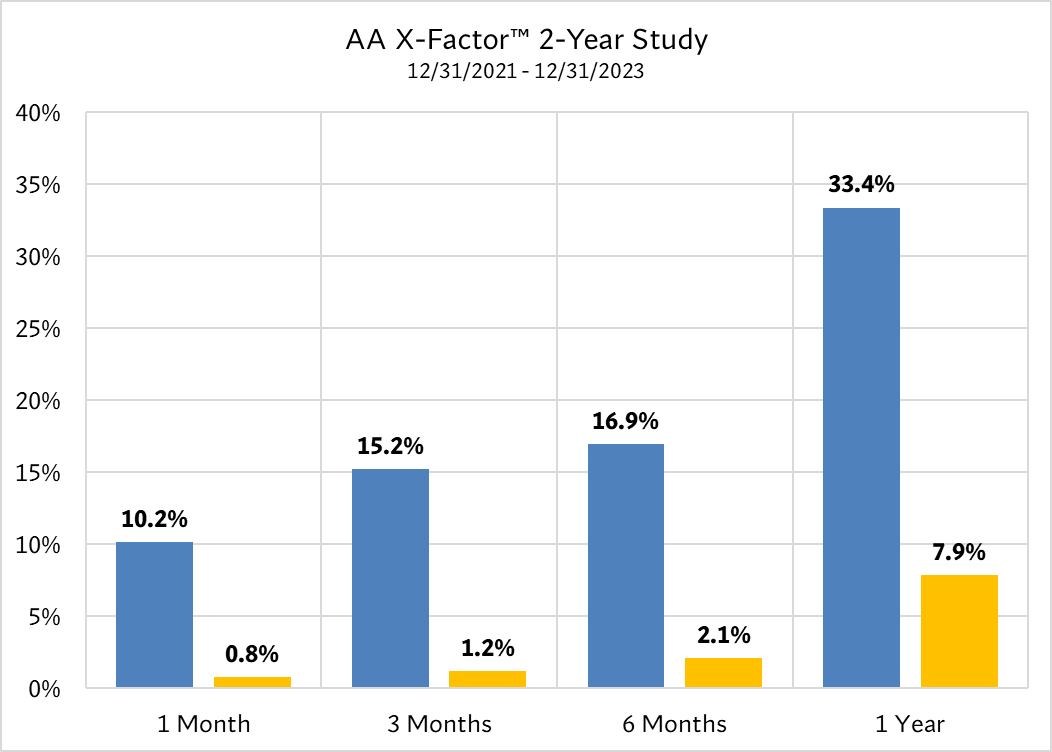

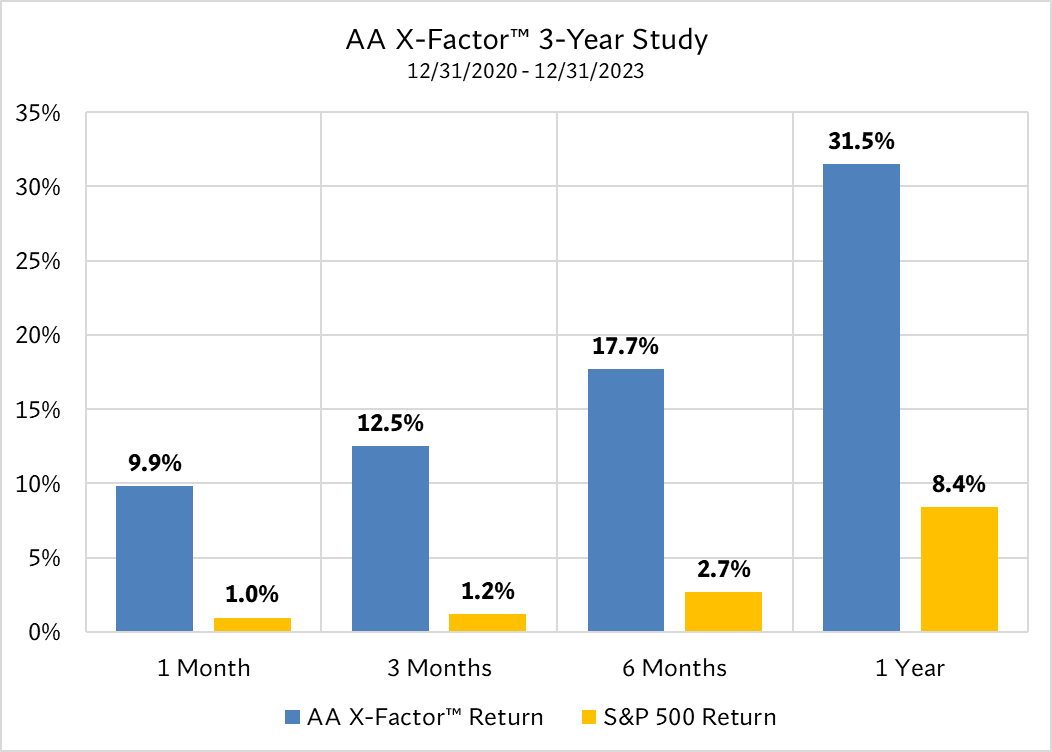

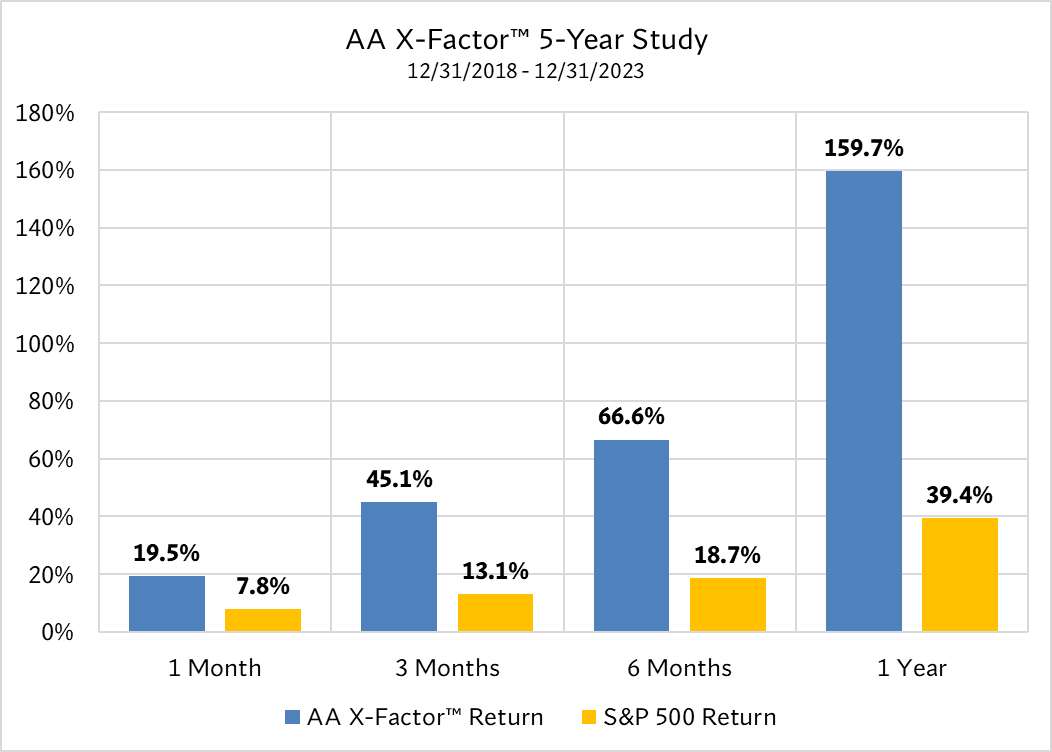

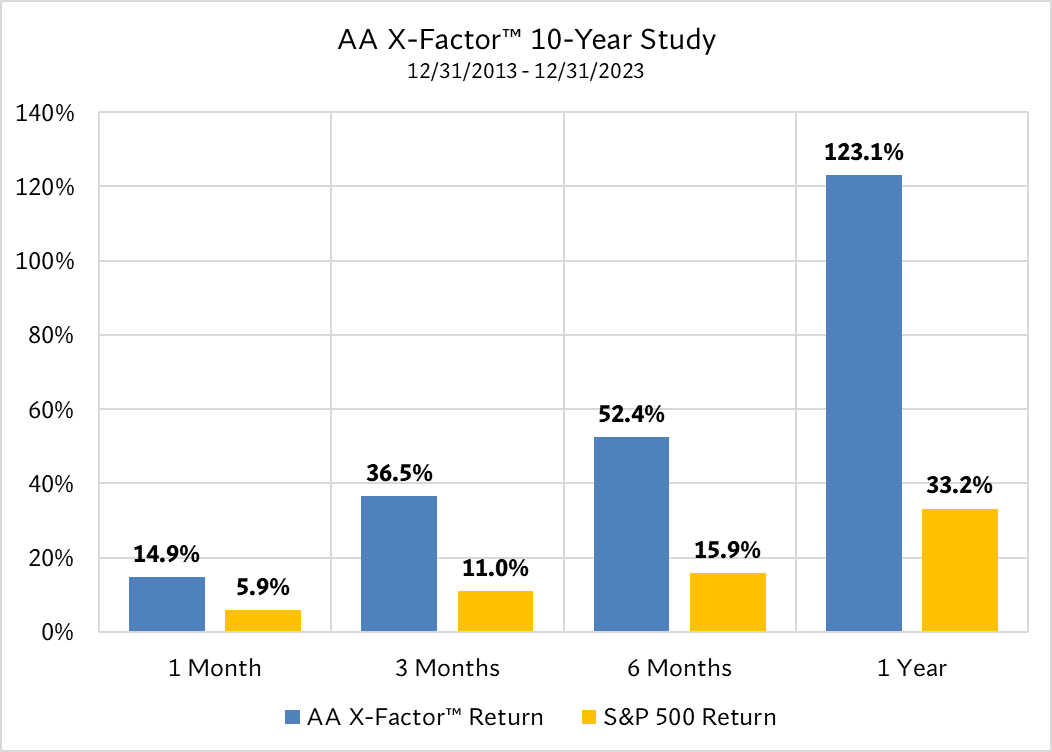

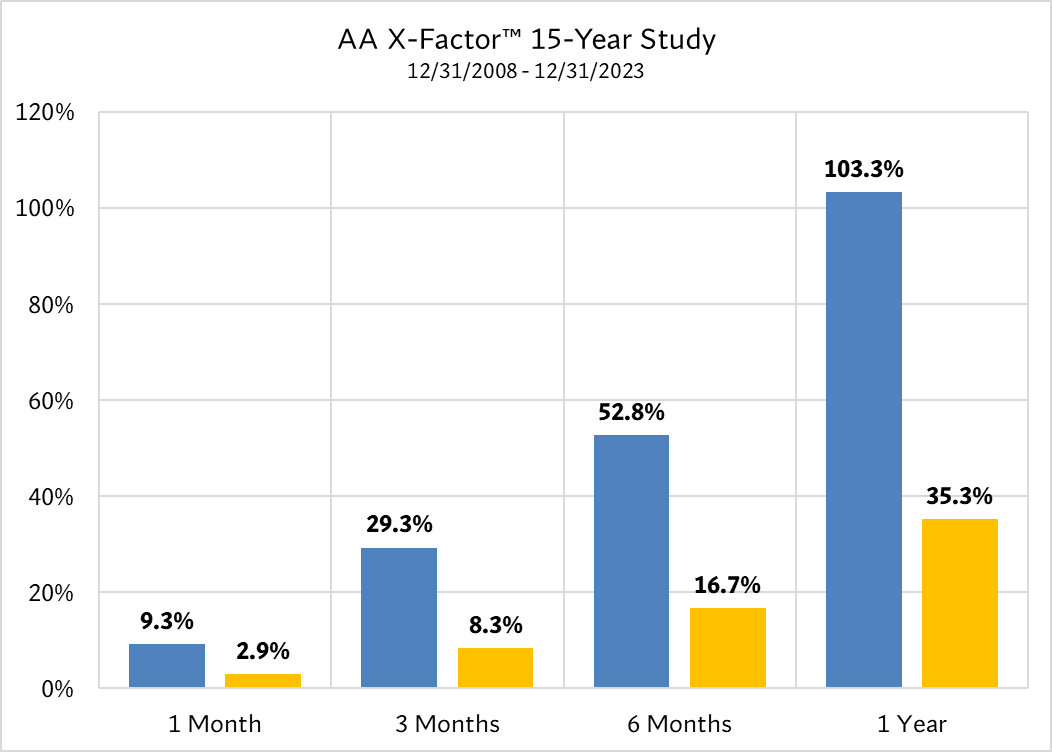

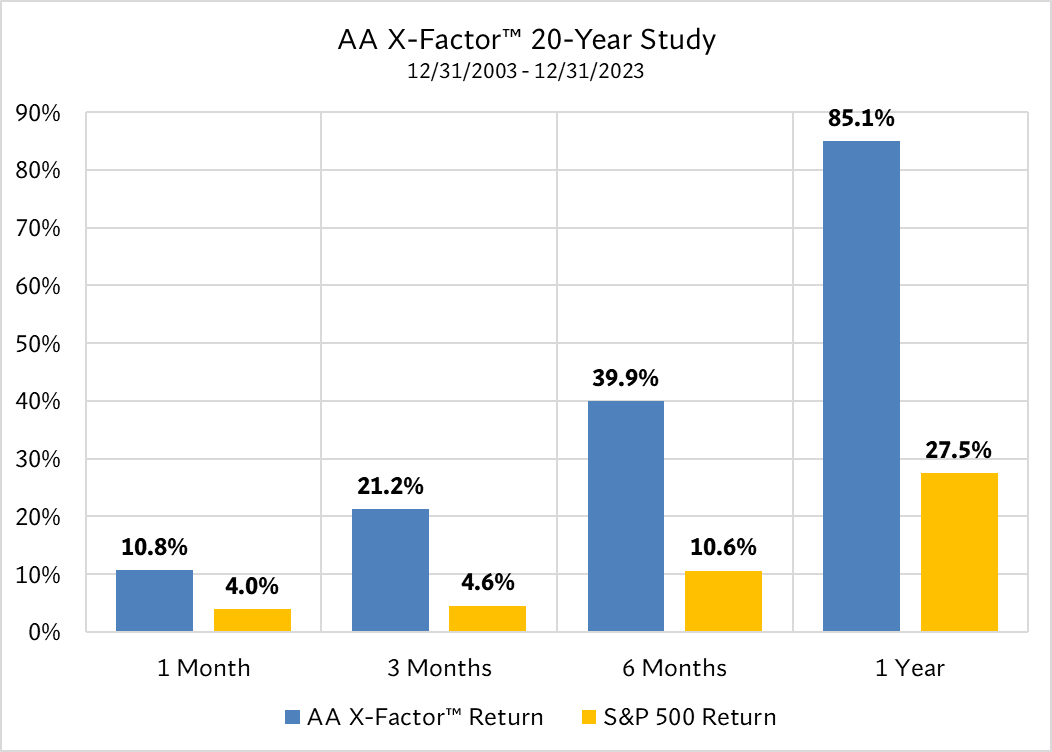

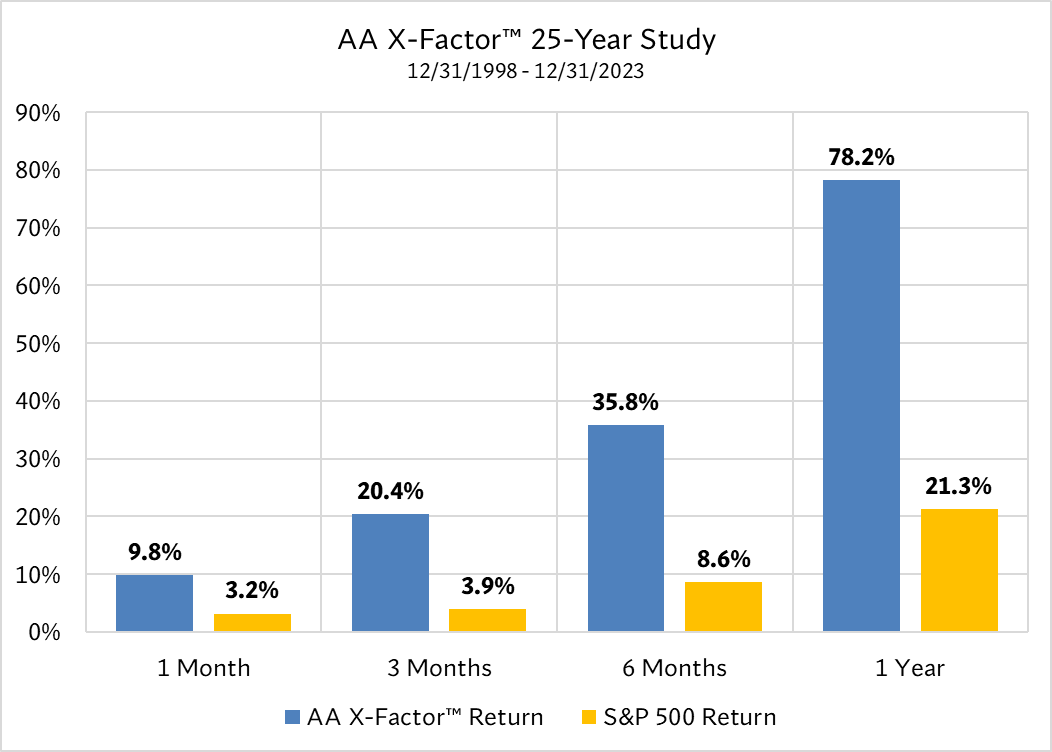

We present a series of studies that exemplify our approach to investment, which is grounded in the application of mathematical and data science principles. The showcased studies are intended to demonstrate the effectiveness of our methods and the results we have achieved in the field of investment.

Becoming an Investor

Our exemplary investment results speak for themselves. By investing in our company, you gain the unique opportunity to benefit directly from our advanced research and proven strategies. We welcome investors who are eager to engage, share their insights, and help steer the company towards new levels of success.

Join Our Company

We are also looking for individuals with a strong background in mathematics and data science to join our board. If you are interested in helping shape the future of our company, contact us today.

Equity Risk Sciences introduces Alpha Algorithmics X-Factor™

We seek joint ventures with hedge funds, family offices, insurance companies and brokerage firms.

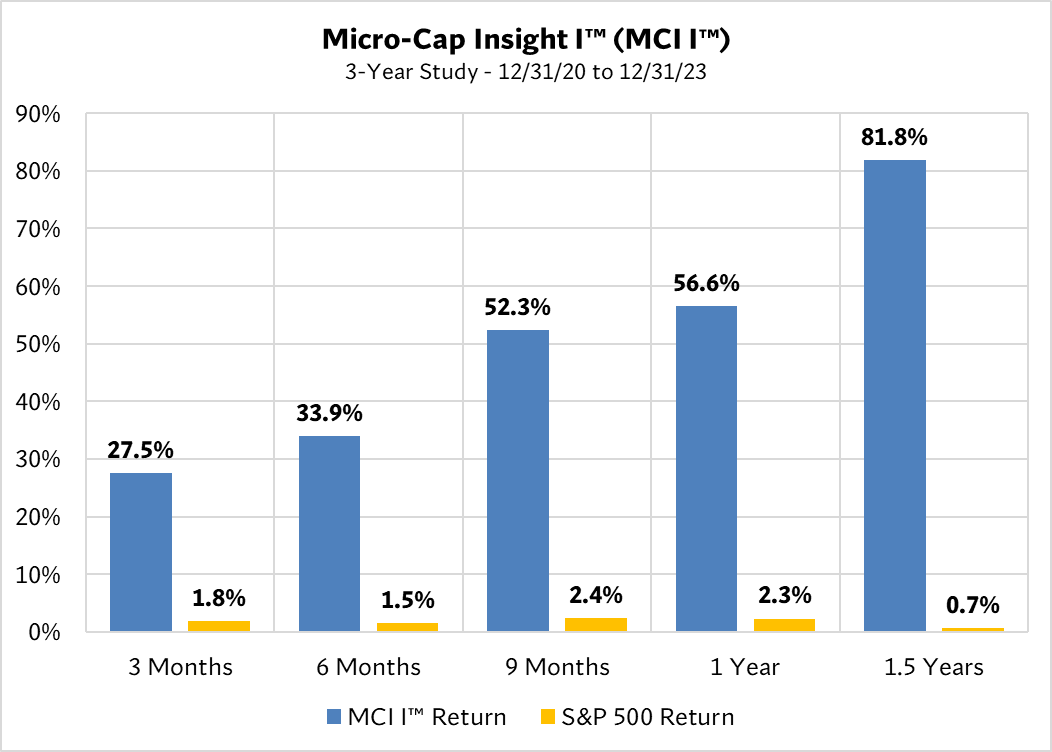

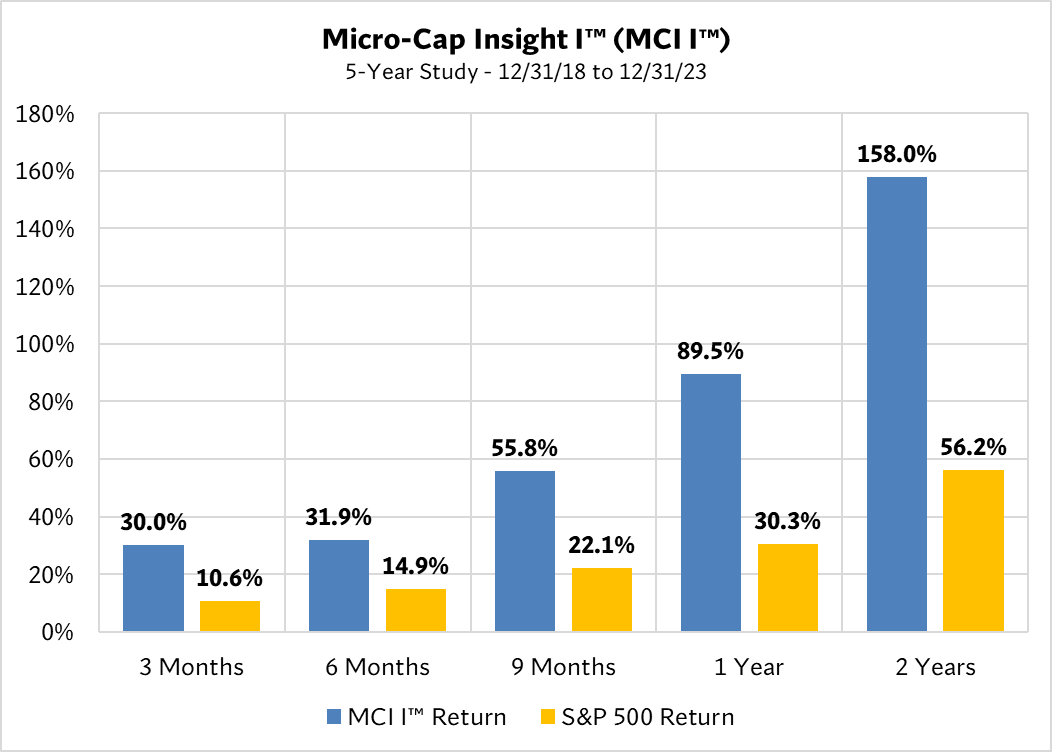

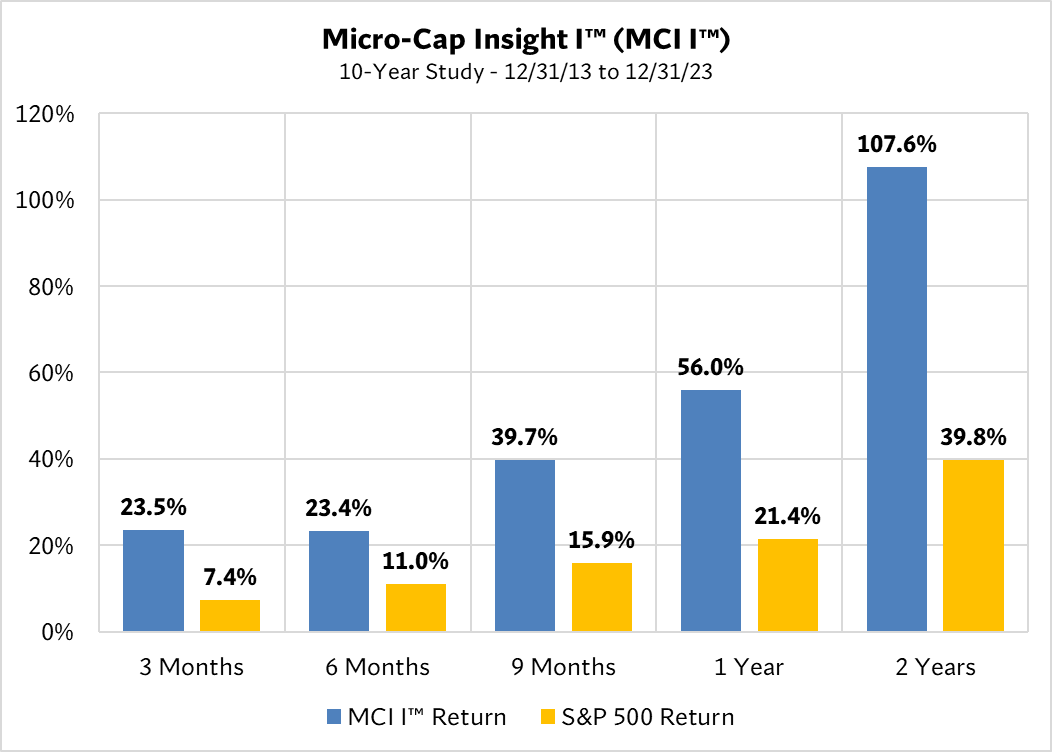

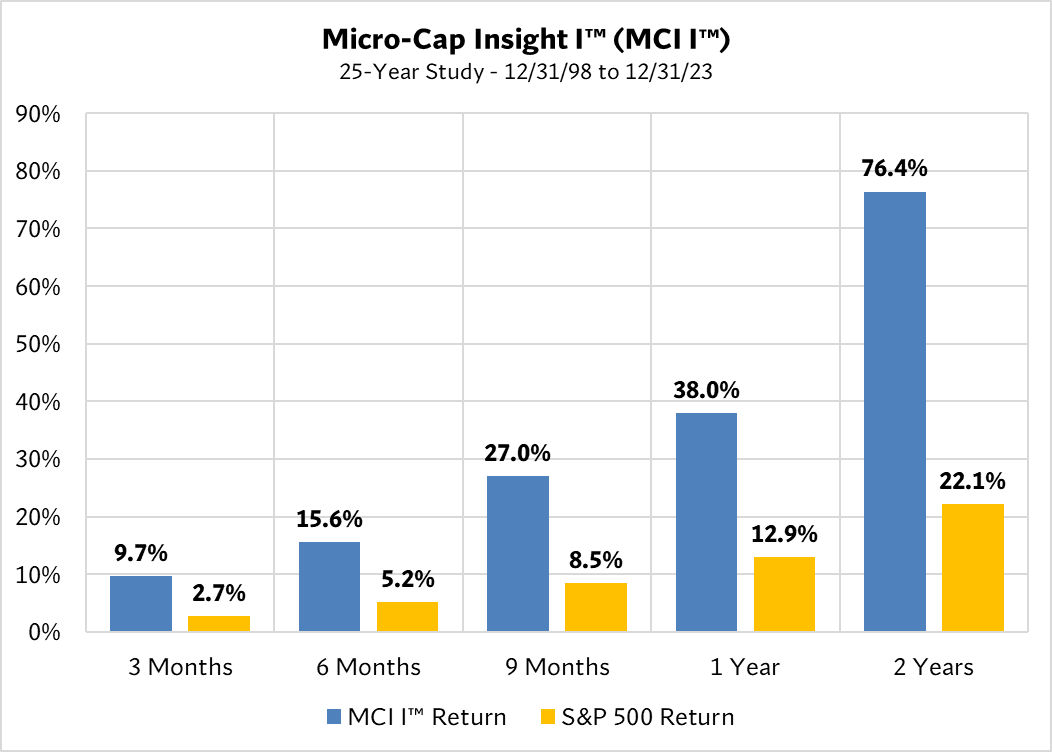

ERS’s Micro-Cap Insight I™ (MCI I™) produced the results below in 4 historic studies: